INCOTERMS 2010

07 04/2021

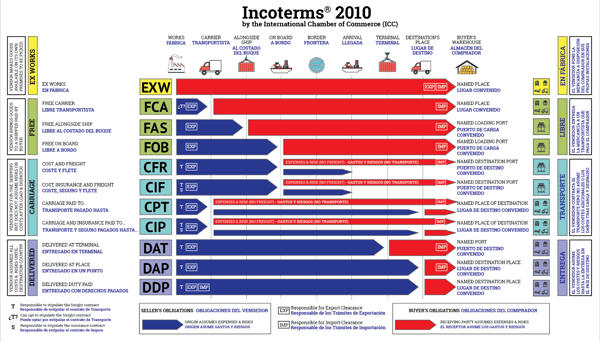

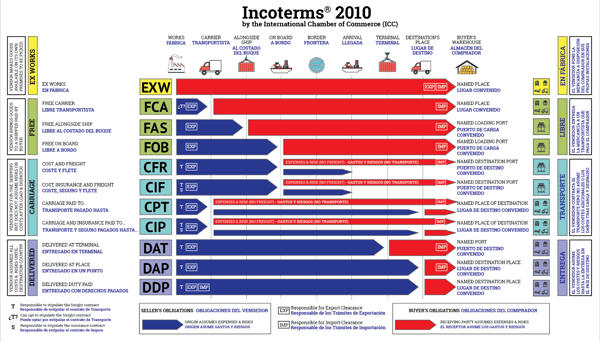

INCOTERMS are essential provisions in international trade, detailing the responsibilities of the seller, the buyer & the time of risk transfer between the buyer and the seller. This section explains some of the changes in INCOTERMS 2010 from INCOTERM 2000.

6 causes of forming INCOTERMS 2010

- Restrictions are rarely used under Incoterms 2010 conditions.

- Enterprises do not understand exactly the obligations and costs in the explanation of Incoterms 2000 giving rise to disputes. For example, the Asian Owners Council (ASC) wants in Incoterms 2010 conditions to specify the costs of making a FOB contract so that shipping carriers do not add unreasonable surcharges.

- After September 11, 2001, terrorist attacks in the US, it is necessary to change the way of managing goods security.

- In 2004, the regulation of US trade rules was completed and changed.

- The rapid development of information technology makes electronic document procedures faster and more compact.

- Regulations on cargo insurance effective from January 1, 2009, replacing the 1982 rule.

SUMMARY OF CONTENT INCOTERMS 2010

In Incoterms 2010 there are 11 terms divided into 4 groups: E - Ex; F - Free; C - Cost; D - Delireres. The application of Incoterms also depends on each case, considering all factors to select the appropriate group.

1. Group E: Delivery at the factory

This can be said that the group that the seller almost does not take any responsibility for the goods and does not need to do anything, including customs declaration for the shipment. Group E usually applies to highly exclusive items that buyers need to buy and sellers are less likely to accept risks or lack of knowledge about import and export.

2. Group F:

In group F, there are 3 groups: FOB, FCA, FAS. F is Free which means exemption from liability. The Group F seller will be exempt from liability (no responsibility) from loading port to discharge port. However, divided into 3 groups in Group F based on the responsibility of each group is different:

2.1 FCA (Free Carrier): Delivery to the carrier

This is a condition of exemption from transport responsibility (Free Carrier). That is, the seller only loads the goods onto the means of transport specified by the purchaser and the means of transport are pre-prescribed (usually the specified buyer). Therefore, after handing over, the seller is not responsible in the process of transporting the goods back to the buyer 's warehouse. If there is any responsibility in the transport process, the seller is not responsible.

2.2 FAS (Free code): Delivery along with the ship

Compared to FCA, FAS has a higher responsibility, the seller has to hire transport vehicles to the side of the ship. According to the above example, the vehicle caught by the traffic is still responsible for your shipment. Responsibility until the goods have been placed along the side of the ship.

2.3 FOB (Free on Board): Delivery on board

Under F conditions, the FOB contract is the highest condition. All costs of customs clearance and tax payment of the seller are responsible. However, the seller did not pay the freight fee because this fee only arises at the time the ship anchors and runs to the delivery port. It means that the ship is anchored, it is ON BOARD (onto the board).

As with Group F conditions, the responsibility will increase: FCA

3. Group C: Subject to additional expenses incurred after condition F

If FOB is only responsible until the ship is anchored, then the condition C of the seller must bear additional responsibilities such as to bear the freight, insurance, ...

3.1 CFR (Cost and Freight): Cash and freight

3.2 CIF (Cost-Insurance and Freight): Freight, insurance, and ship charges

3.3 CPT (Carriage paid to): Charges paid

4. Group D:

4.1 DAT (Delivered at the terminal): Delivery at the port

4.2 DAP (Delivered at a place): Delivery at destination

4.3 DDP (Delivered duty paid): Delivery of customs clearance

1. Responsibilities to hire transport means:

2. Responsibility for purchasing insurance for goods:

3. Responsibility for customs procedures for goods:

3. Group C: Subject to additional expenses incurred after condition F

If FOB is only responsible until the ship is anchored, then the condition C of the seller must bear additional responsibilities such as to bear the freight, insurance, ...

3.1 CFR (Cost and Freight): Cash and freight

The seller must bear the cost of shipping (shipping), and the cost of unloading at the port of the buyer will be responsible if agreed.

Thus: CFR = FOB + F (sea freight)

3.2 CIF (Cost-Insurance and Freight): Freight, insurance, and ship charges

This is a fairly common condition in import and export. The seller must bear the additional premium for the shipment during the process of transfer by ship. When shipping, the shipment is damaged, then the insurance will be responsible, the seller is jointly responsible and the buyer is not responsible for anything. Seller (the shipper) can buy insurance at a minimum according to FPA or ICC (C) -110%.

Thus: CIF = CFR + I (insurance) = FOB + F (sea freight) + I (insurance)

3.3 CPT (Carriage paid to): Charges paid

CPT = CFR + F

F is now the non-shipping freight from the port of discharge to the seller-designated delivery location, this F includes the freight charge. So compared to CIF, CPT has to bear other transportation costs.

4. Group D:

4.1 DAT (Delivered at the terminal): Delivery at the port

In this case, the seller delivers goods at a specified port. And the position of risk conversion is the seller who delivers the goods. If the buyer wants the seller to take additional risks, use DAP or DDP conditions.

4.2 DAP (Delivered at a place): Delivery at destination

The seller will bear all risks until the right position of the buyer is delivered on the means of transport and ready to unload the goods at the destination.

But the seller will not be responsible for customs clearance. This is the biggest difference between DAP and DDP. If you want the seller to take all risks until the goods are cleared, use the DDP condition.

4.3 DDP (Delivered duty paid): Delivery of customs clearance

In this condition, the seller bears all risks until the goods are brought to the place and bear all responsibility for customs clearance.

SOME NOTES OF RESPONSIBILITIES AND SELLER'S OBLIGATIONS AND BUYERS IN INCOTERMS 2010

1. Responsibilities to hire transport means:

* Group E, F: Buyers hire ships. Delivery location is at the destination.

* Group C, D: Belong to the seller. Delivery location is in place.

4 conditions in Incoterms 2010 only apply to sea and inland waterway transport: FAS, FOB, CFR, CIF: delivery locations (other than responsibility transfer) are seaports.

2. Responsibility for purchasing insurance for goods:

* Group E, F: The buyer must buy insurance for the shipment

* Group D: responsibility belongs to the seller.

* Group C: Depending on the case

o CIF, CIP: seller.

o CFR, CPT: buyers.

3. Responsibility for customs procedures for goods:

Export:

* EXW: buyers do all customs procedures for taking goods at the seller warehouse.

* 10 remaining conditions: the seller must carry out customs procedures at the port of his / her export (port of departure).

Import:

* DDP: seller.

* The remaining 10 conditions are the buyer at the port of delivery.

Similarities of Incoterms 2000 and Incoterms 2010

- There are 07 commercial conditions: EXW, FAS, FOB, CFR, CIF, CPT, CIP

- Recommended to apply waterway vehicles for the following conditions: FAS, FOB, CFR, CIF

- Applicable to all types of transport and multimodal freight forwarding for the following conditions: CPT, CIP, DDP

- Both Incoterms 2000 and Incoterms 2010 are not laws. The parties may apply fully or may apply in part, but when applied clearly in the foreign trade contract, other applications must necessarily be described carefully in the foreign trade contract.

The difference between Incoterms 2000 and Incoterms 2010

|

|

Comparison criteria

|

Incoterms 2000

|

Incoterms 2010

|

|

1

|

Number of trade conditions

|

13

|

11

|

|

2

|

Group numbers are divided into

|

4

|

2

|

|

3

|

Method of grouping

|

According to freight forwarding costs and risk transfer locations

|

In the form of transport: waterway and other means of transport

|

|

4

|

Obligations related to ensuring cargo security

|

No specified

|

Regulations A2 / B2; A10 / B10

|

|

5

|

Recommended where Incoterms apply

|

International commerce

|

International and domestic trade; used in bonded areas

|

|

6

|

Regulations on related costs

|

Not regulated

|

Regulated: A4 / B4 & A6 / B6

|

|

7

|

Commercial conditions DES, DEQ, DAF, DDU

|

Yes

|

No

|

|

8

|

Commercial conditions: DAT, DAP

|

No

|

Yes

|

|

9

|

Where to transfer risks of FOB, CFR, CIF conditions

|

Railing ships

|

Finished goods on board

|

|

10

|

Regulations on cost sharing when doing business in a chain (sales in the transport process)

|

No

|

Yes

|

Insights and News